ACCOUNTING SOLUTIONS

We are obsessed with creating a unique money story in your business, you're proud of.

Accounting solutions for Passionate

Business Owners and Key Decision-Makers.

Vanessa Gant

Money Architech

Your Challenge of Financial Chaos Ends Here.

From startup founders to seasoned entrepreneurs, managing transactional record-keeping can be overwhelming. Stress and uncertainty arise from incomplete financial records, hindering your ability to make informed decisions and achieve your unique business goals.

Transactional record-keeping is a common challenge for businesses – time-consuming, error-prone, and a source of stress. Maintaining financial order and seeking comprehensive solutions aligned with your unique business goals can be daunting. Entrepreneurs often find themselves in need of strategic insights and expert guidance to navigate financial complexities and maximize growth potential.

Feel the weight of stress and uncertainty from incomplete financial records? Fear not; ProVision is here to guide you through the complexities.

Join our mailing list to get insights on your financial.

Fill in the form below and I'll contact you soon

"Take charge of your business destiny with organized finances – your key to empowerment and success."

Shouldn't your financial records be a testament to the precision and professionalism that defines your company?

Consider the allure of being the company that undergoes QuickBooks cleanups with finesse, ensuring that every entry reflects the commitment to accuracy and order. Our QuickBooks cleanup services aren't just about tidying up spreadsheets; they are about crafting a narrative that speaks volumes about your dedication to operational excellence.

As you dream beyond the ordinary, picture having a Fractional CFO standing beside you, guiding your financial ship through uncharted waters with strategic insights and seasoned expertise. Shouldn't your business be the one that benefits from the wisdom of a financial leader without the cost of a full-time executive?

Now, envision tax season not as a stress-inducing annual event but as a seamless process facilitated by experts who have meticulously prepared your financial groundwork. Shouldn't your business enjoy a tax season that is not just manageable but stress-free?

WORKING TOGETHER

Getting Started Is Easy.

01

Schedule a Consult

Schedule a consultation at the link on this page.

02

Access The Assessment

We will assess your current financial situation confidentially.

03

Create Your Money Plan

We will deep dive and create your money plan for relief, organization, and maximum profits.

04

Your Numbers Soar

Watch your numbers take off and finally present in a way that makes you excited to talk about it!

Our services are designed to be your financial navigator,

expertly leading you through the complexities of

financial management and wealth strategies.

Quick Books

Set-up

Fractional

CFO Services

Tax

Preparation

Accounting

Services

Hiring the Money Architect is not just a luxury for businesses; it's a strategic necessity.

Transactional record-keeping is a common challenge for businesses – time-consuming, error-prone, and a source of stress. Maintaining financial order and seeking comprehensive solutions aligned with your unique business goals can be daunting. Entrepreneurs often find themselves in need of strategic insights and expert guidance to navigate financial complexities and maximize growth potential.

Feel the weight of stress and uncertainty from incomplete financial records? Fear not; ProVision is here to guide you through the complexities.

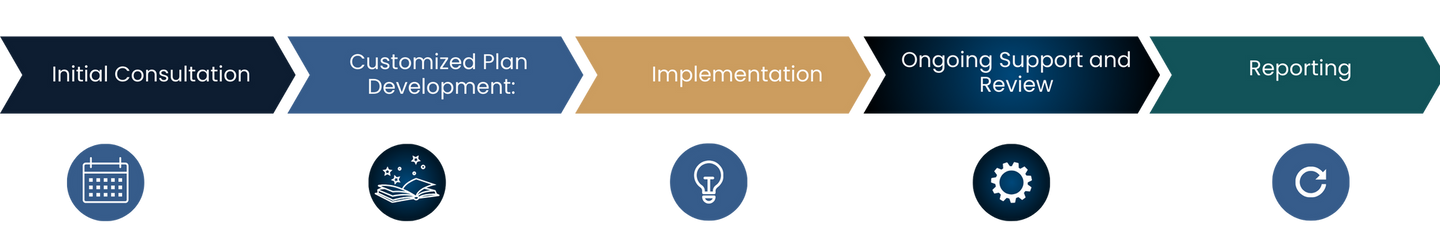

Our Unique Process.

Choosing ProVision Accounting Services means achieving financial stability and fostering growth. Success manifests in a well-organized financial structure, accurate records, and the ability to make informed decisions. The business not only survives but thrives under the guidance of comprehensive financial solutions.

Money Talks Blog

Here's Why You Need ProVision Accounting As The Money Experts in Your Business.

See some common questions and answers below, or call us at